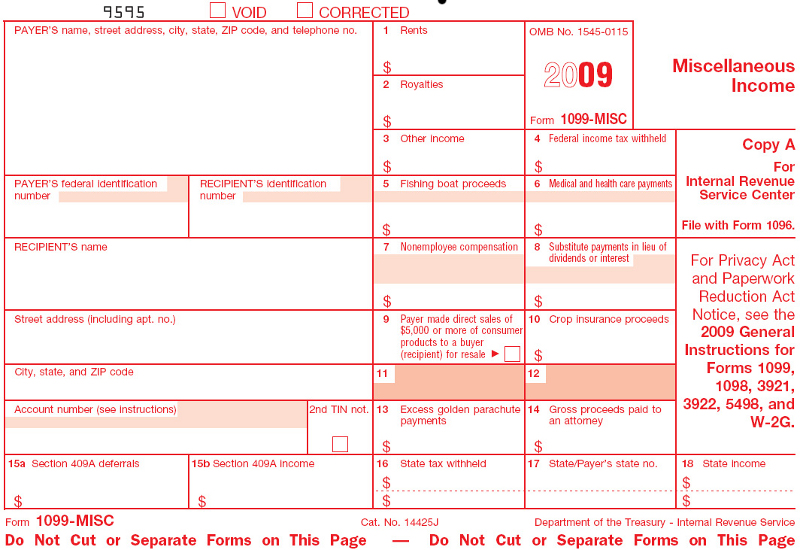

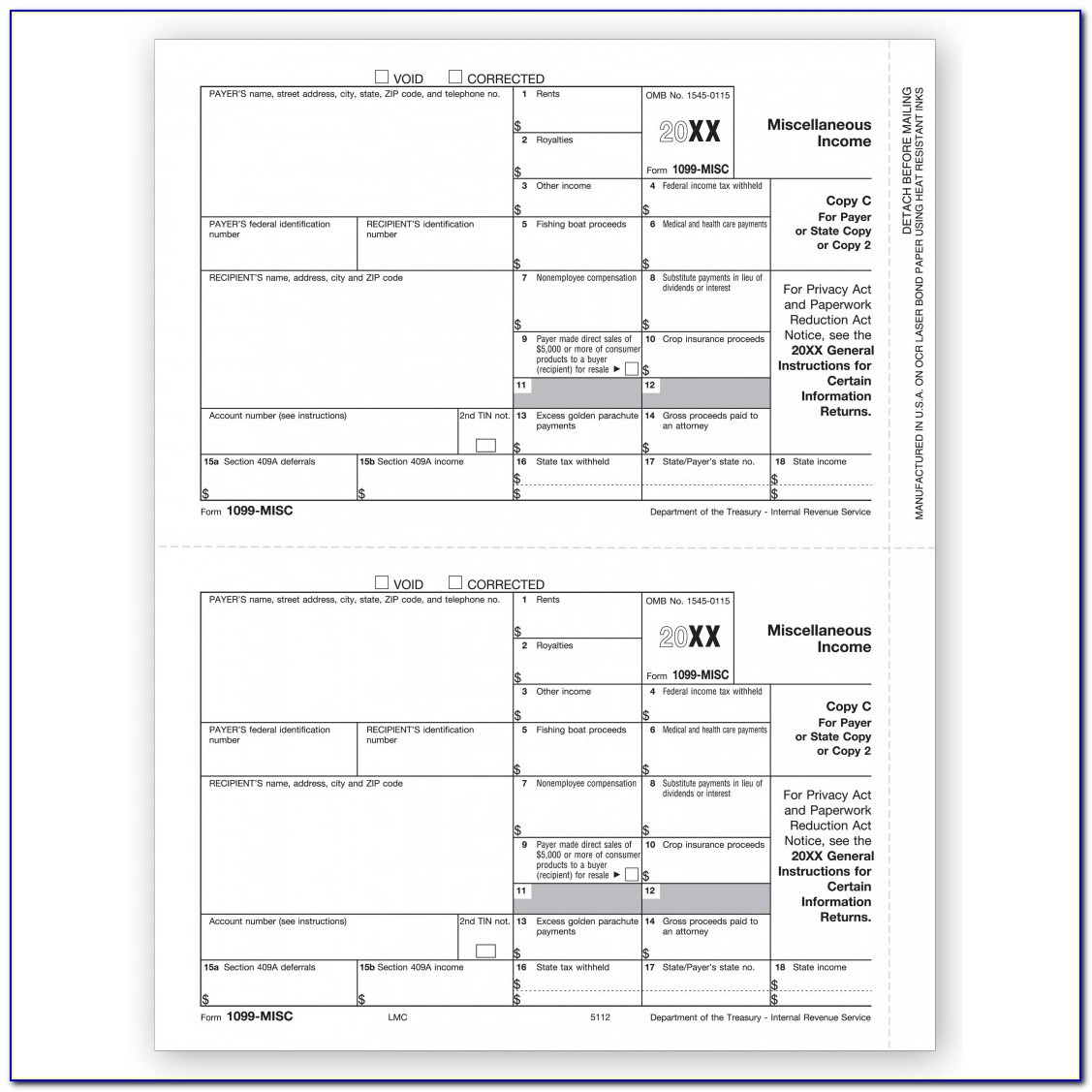

Person” and you earn money working through Upwork, you need to report this income on your tax return even if you do not get any forms from us. If you're a freelancer whom the Internal Revenue Service (IRS) defines as a “ U.S. While we can’t provide you with legal or tax advice, we can clarify which documents you will receive from us. We know taxes can be difficult, especially figuring out which forms you need. If you reach this amount, you will receive a Form 1099-K from Upwork in 2023 for your 2022 transactions. Person and receive at least $20,000 in payments from your clients on Upwork in 2022 that included 200 or more transactions. You will still receive a Form 1099-K if you are a U.S.

The IRS has delayed their requirement for third party settlement organizations such as Upwork to report transactions of at least $600.

0 kommentar(er)

0 kommentar(er)